How we invest

Pantheon International’s aim is to grow your capital over the long term by investing in a portfolio of private companies alongside leading private equity managers globally.

Our investment strategy is set out clearly and implemented within the parameters of our investment policy.

Our approach

We invest in growing private companies, either directly or through funds, using Pantheon’s 40+ years of experience.

Pantheon sources private equity opportunities that we can invest in directly. So we have full control over what we invest in and when.

We manage the maturity profile of our portfolio. This means that we consistently receive cash when mature companies are sold while also benefitting from the growth in value of younger investments.

Our flexible investment process

PIN has the opportunity to participate in all of the private equity investments sourced for it by Pantheon.

Pantheon sources investment opportunities in companies and funds using its extensive and well-established investment teams.

We invest with many of the best private equity managers globally, who are able to identify and create value in their portfolio companies.

Cash generated from the sale of those companies is returned to Pantheon International and redeployed into new investment opportunities, including share buybacks, in accordance with our capital allocation policy.

PIN’s portfolio consists of three types of investment – primaries, secondaries and co-investments – with each offering their own merits:

Co-investments

We invest in a company directly, alongside a private equity manager.

- Direct investment in individual companies that have attractive growth characteristics and have effectively passed through two layers of scrutiny, alongside PIN’s leading private equity managers.

- This boosts the performance potential as an individual company investment has been selected by Pantheon, rather than it being part of a fund, and there are typically very low or no fees, making it a cost-effective way of capitalising on the high value added by PIN’s selected managers.

- Co-investments are through invitation only and are therefore not accessible to most investors.

Manager-led secondaries

Alongside a private equity manager, we invest directly in a company that the manager has already owned for a period of time and therefore knows well.

- We partner with high-quality private equity managers to acquire, as single transactions, their most attractive portfolio companies via a continuation fund.

- Typically, fees are lower than those on primaries.

- This provides an opportunity to invest in an asset that the private equity manager believes has potential for further growth, at a time when the fund in which it is held has limited time or capital remaining to the end of its life.

Primaries

We invest in a new private equity fund when it is established.

- We capture exposure to leading managers as well as to smaller niche funds that are generally hard to access.

- We target leading managers predominantly in the USA and Europe.

- Primaries invest capital into companies over an investment period of typically five years, providing steady deployment over time and diversification by vintage year, sector and geography.

Fund secondaries

Fund secondaries involve the purchase of existing investor interests in private equity funds. Rather than investing in companies directly, secondary fund investors acquire stakes in funds that are already part way through their lifecycle, often with partially or fully deployed capital.

- Our fund secondaries are interests in high-quality private equity funds, providing liquidity to existing investors who seek an early exit.

- These transactions offer enhanced visibility into the underlying portfolio, as many of the assets are already acquired.

While PIN has exposure to fund secondaries, it is no longer investing in this type of investment and we expect our exposure to fund secondaries to diminish over time.

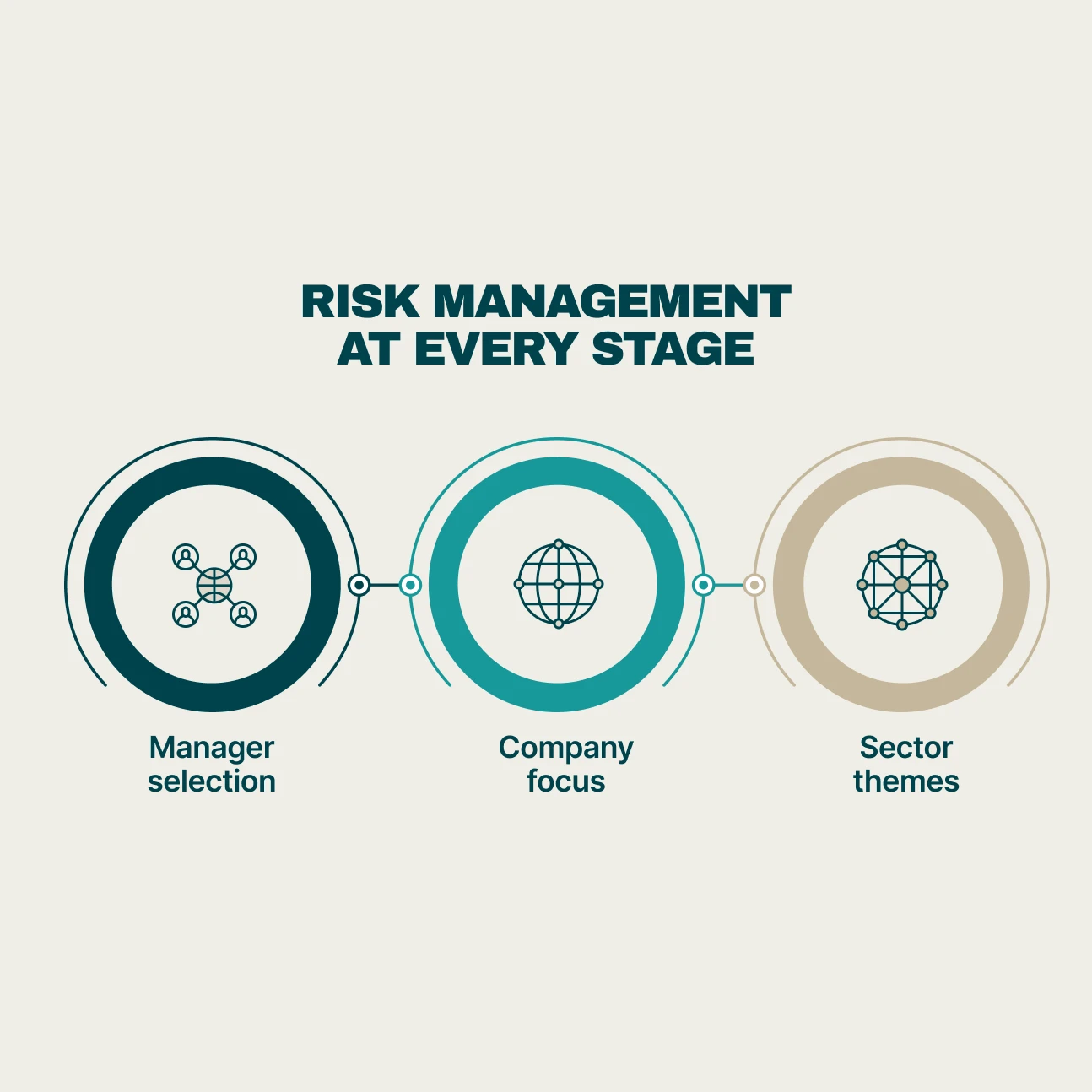

We manage opportunities and risks at all stages of the investment process

On behalf of PIN, Pantheon’s selection of private equity managers is underpinned by a rigorous and thorough due diligence process. A manager’s likely future performance can be assessed by analysing their organisation, detailed past track record, investment strategy and competitive positioning. A key factor is the manager’s ability to outperform the public markets. This also applies to single company investments where, over the medium to long term, we have taken more concentrated positions in companies that are under strong stewardship and have resilient profiles.

While PIN invests in all stages of a company’s growth, we favour small and medium-sized companies. These well-established businesses offer many pathways for growth with the help of the private equity manager and their operational experts. Also, these companies typically use more moderate levels of debt compared with those at the large/mega end of the industry. There are several routes through which to sell the companies, which is another attractive factor.

It is Pantheon’s objective to identify and access leading managers globally that take a thematic approach and focus on high-growth sectors, many of which may not be fully represented by the public markets, may be experiencing dislocation or where underlying growth is less correlated to GDP growth and they are benefiting from long-term trends.

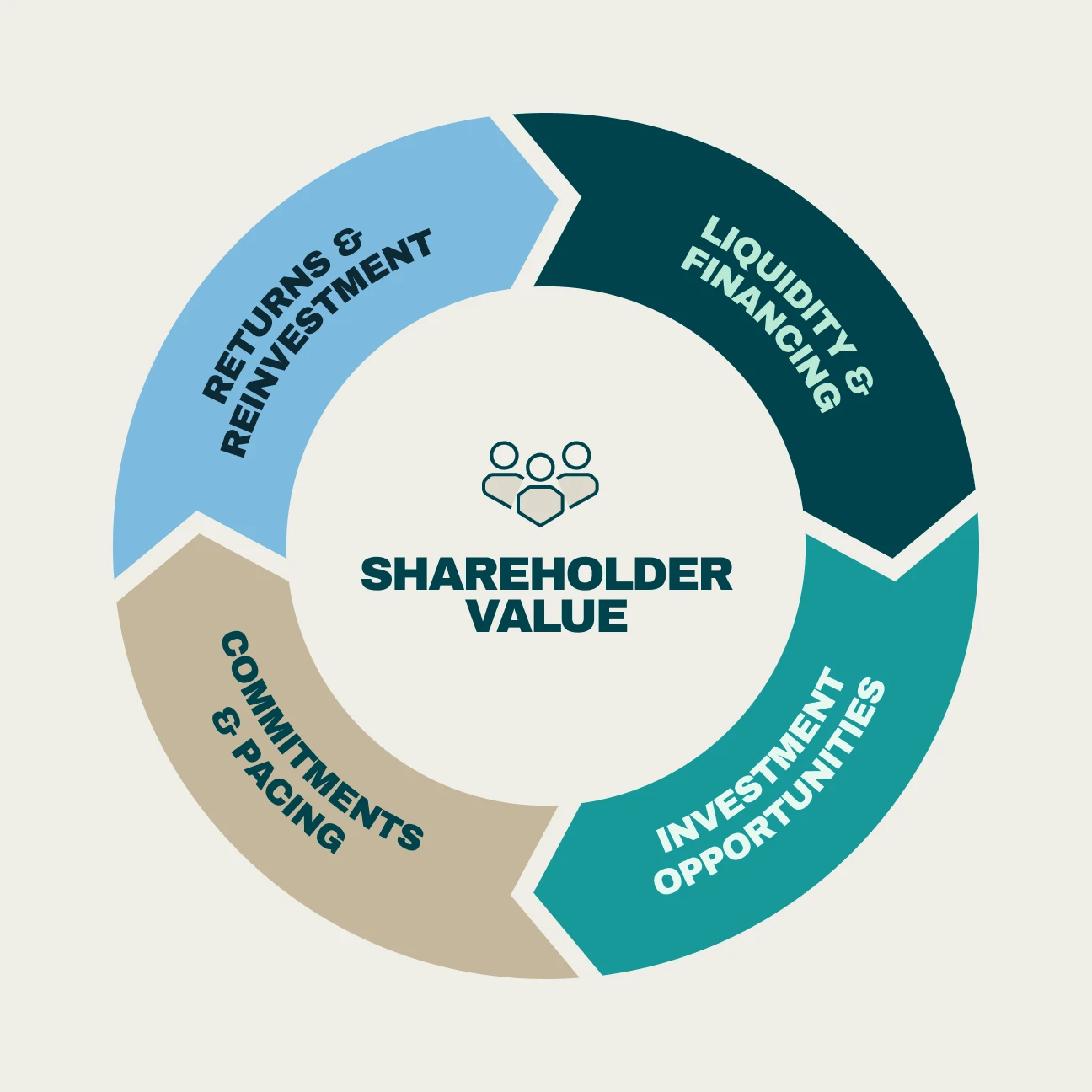

A well-defined capital allocation policy

When PIN’s shares are trading at a wide discount to the net asset value (“NAV”), they can offer a compelling investment opportunity. Our capital allocation policy aims to strike a balance between buying back shares as well as investing in new deals that have the potential to boost performance in the future. Our policy seeks to ensure that sufficient capital is dedicated to share buybacks when reinvesting in the portfolio is both compelling and accretive to the NAV per share. As part of our policy, 20% of gross distributions will be allocated to a distribution pool. The pool will be deployed over time at the Board’s discretion and in the interests of shareholders. Click here for further information: Update on Corporate Strategy Programme.

We maintain a diverse and flexible capital structure

We manage Pantheon International to ensure that it has sufficient cash to finance its undrawn commitments as well as to take advantage of new investment opportunities. Undrawn commitments represent amounts that have been promised to a fund to support future investments but have not yet been requested by and paid to the private equity managers. A critical part of this process is ensuring that the undrawn commitments do not become excessive relative to PIN’s available financing. We achieve this by managing PIN’s investment pacing as well as constructing its portfolio to ensure the right balance of exposure to the different types of investments.

PIN has access to a £400m multi-currency credit facility, which can be increased to £700m, and US$150m of private placement loan notes. The measured use of debt to reduce cash drag and enhance NAV growth is central to PIN’s strategy. New investments, capital calls (amounts requested by managers that reduce undrawn commitments) and share buybacks will be funded primarily by cash distributions from our underlying portfolio. Where appropriate, we may also draw down on the credit facility and sell assets in the secondary market.

We report on our financial position in our monthly newsletters.

Why

invest

in

private

equity

Private equity can be an attractive asset class for many investors as it can boost the long-term performance of their investment portfolios.