Arnott Industries

Private Equity Manager (GP)

Calera Capital

Details

Region

USA

Sector

Consumer

Stage

Medium buyout

Type

Fund secondary

Vintage

2015

Exit Type

Secondary Buyout

Highlights

Proceeds

£19.0m

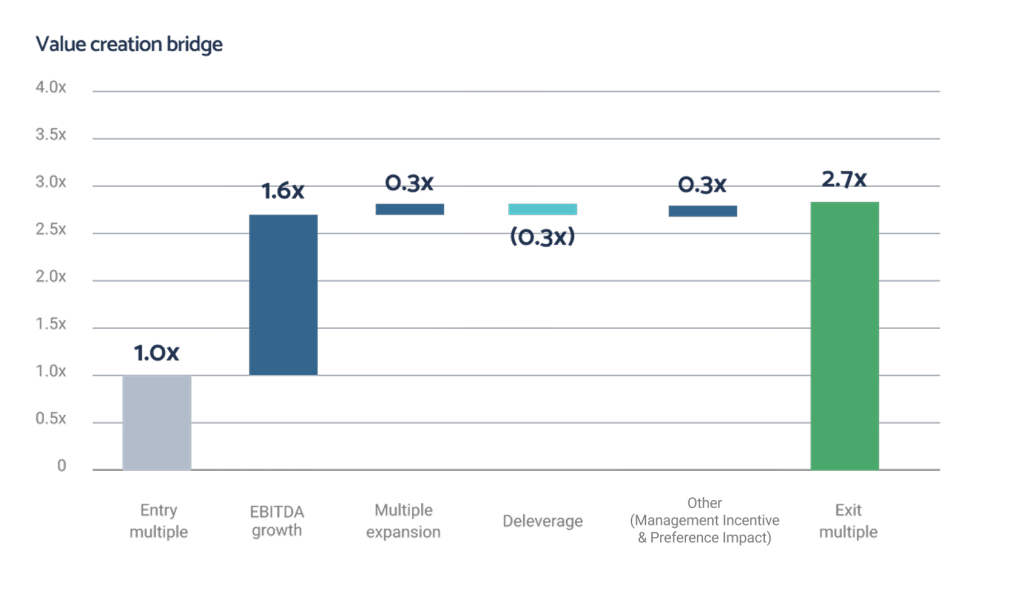

Exit multiple

2.7x

IRR

15%

About the

company

Arnott Industries (“Arnott”), founded in 1989, is a global leader in the engineering and manufacturing of aftermarket replacement air suspension products and accessories for passenger vehicles.

Headquartered in Florida, the company offers a comprehensive range of products, including air struts, air springs, compressors and conversion kits.

Arnott’s products improve the ride quality of a range of cars and trucks, including vehicles manufactured by Audi, BMW, Cadillac, Mercedes-Benz and Porsche.

Arnott is known for its commitment to quality and innovation, serving the automotive aftermarket with reliable and high-performance solutions.

Investment rationale

- At the time of investment, Arnott Industries had a robust and scalable business model with substantial untapped growth potential.

- Arnott’s strong competitive position in aftermarket air suspension products provided a strong foundation for future growth.

- There was the potential to create value through accelerated new product launches, geographic expansion and accretive add-on acquisitions.

- The partnership with Arnott’s founder, Adam Arnott, and CEO, Joe Santangelo, was central to the success of this investment.

Our relationship

Pantheon has a long-established relationship with Calera Capital, having previously invested in two secondary deals in their funds. Pantheon subsequently made a primary investment into Calera Capital Partners V.

Active management and value creation

- Over the course of the investment period, Arnott expanded its operations to serve customers in over 50 countries.

- Arnott grew its core product line to over 800 offerings, all while continuing to provide a quality service to its key distribution and installer partners.

- Company revenue more than doubled during PIN’s ownership, with double-digit organic growth rates and the completion of four highly strategic and accretive add-on acquisitions.

Exit

- In November 2024, Arnott was acquired by MidOcean Partners, a US-based private equity manager specialising in middle-market private equity, structured capital and alternative credit investments. PIN made a return of 2.7x on the original cost and an internal rate of return (“IRR”) of 15%.