Olink Proteomics

Private Equity Manager (GP)

Summa Equity

Details

Region

Europe

Sector

Healthcare

Stage

Small/medium buyout

Type

Co-Investment

Fund Vintage

2019

Exit Type

Strategic sale

Highlights

Proceeds

£11.5m

Net IRR

62%

Return on the original cost

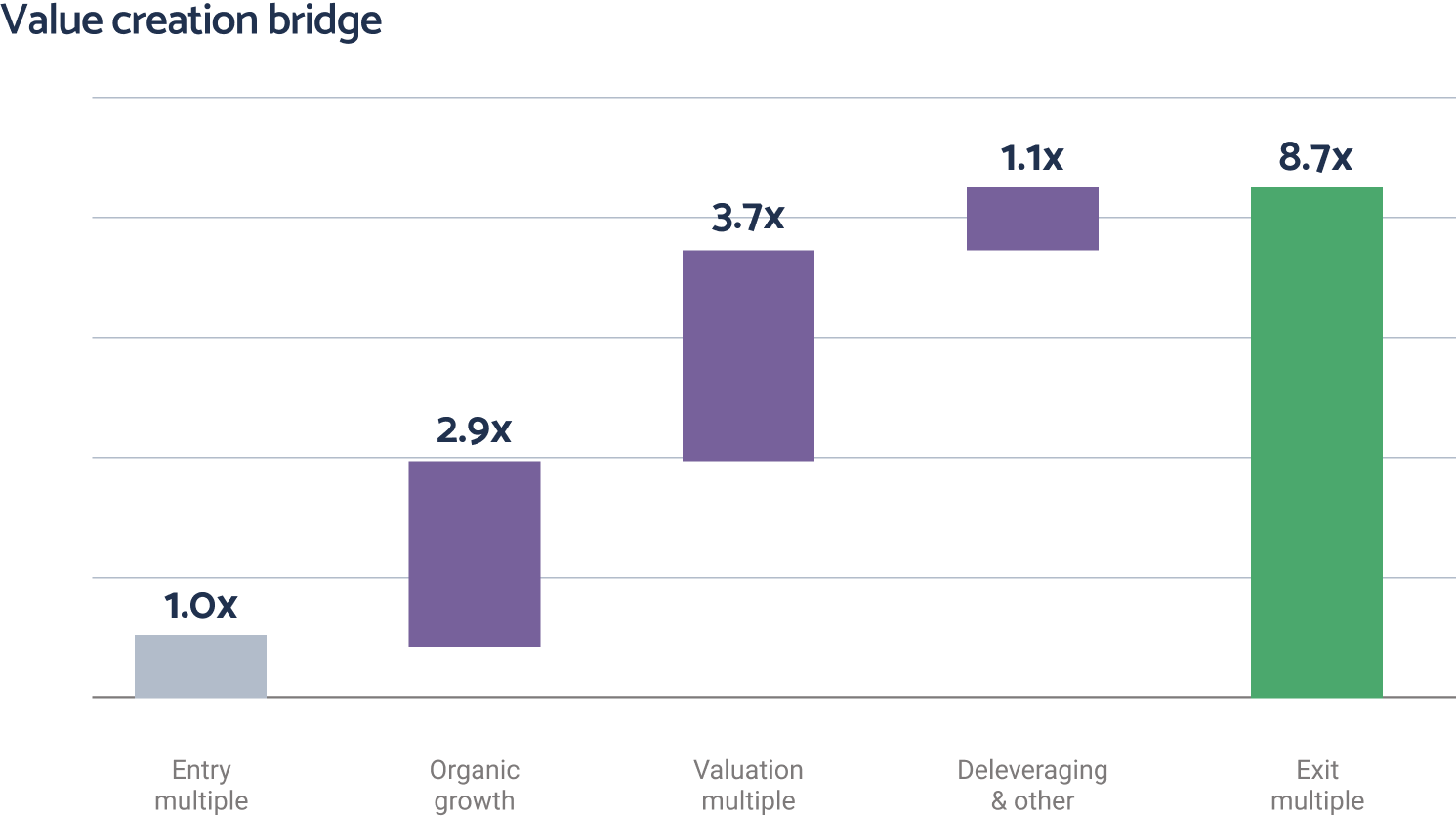

8.7x

What Olink Proteomics does

Olink Proteomics (“Olink”) helps scientists to better understand diseases by studying proteins, which play a key role in how human bodies function and how diseases develop.

The company developed a unique technology called “Proximity Extension Assay”, which allows researchers to measure thousands of proteins in a single test, using only a tiny sample. Olink sells testing kits and laboratory services to universities, pharmaceutical companies and medical researchers.

Why we invested

- Proteomics is an important tool for studying diseases, providing crucial insights into their molecular mechanisms; as a result, proteomics is a large and growing market – estimated to be c. $1 billion in 2023 and expected to grow more than 10% per annum.

- Olink’s technology was well proven and validated in the market by a large number of pharmaceutical companies and leading academic institutions.

- Before the 2019 investment, the company’s unique market position had already delivered strong, profitable growth, with revenue growing at a 111% cumulative annual growth rate from 2016 to 2018.

- Summa Equity’s expertise in both this specialised part of the healthcare sector and in professionalising fast-growing companies would benefit Olink, particularly given the stage of the investment.

Value creation

- Took Olink from niche player to global leader in proteomics, which now offers a leading technological solution for protein analysis in human protein biomarker research.

- Delivered strong top-line revenue performance over the holding period (c. 40% cumulative annual growth rate from 2018 to 2023), despite a challenging macroeconomic backdrop.

- Grew the company’s customer base from approximately 300 at entry to over 1,000 clients today.

- Won multiple key accounts, with 19 out of 20 top biopharma in the world now being Olink customers, along with most of the world’s largest biobanks.

- Launched new product platforms that today constitute the vast majority of revenue and have the potential to enable future diagnostics solutions.

- Bought and integrated complementary businesses and accelerated research and development (“R&D”) and product launches.

Outcome

Summa Equity and Pantheon International sold Olink to Thermo Fisher Scientific, generating an 8.7x return on the original cost, with a net IRR of 62%.