Protecting and enhancing value over the long term

Our manager Pantheon and the Board of PIN believe integrating material sustainability considerations throughout our processes supports our wider objective to manage risks and create long-term value in PIN’s portfolio.

Our board oversight

The Directors of PIN have oversight of sustainability matters within PIN’s portfolio and fully support Pantheon’s longstanding commitment in this area. Pantheon is responsible for implementing its group-wide Sustainability Policy, including within PIN’s investment process and portfolio, to ensure that sustainability risks and opportunities are appropriately integrated into investment decision-making throughout the lifecycle of PIN’s investments. The policy is reviewed and updated by Pantheon’s Sustainability Committee on a periodic basis, and the objective is to complete this at least annually.

PIN’s Sustainability Lead, Board Director Dame Sue Owen DCB, is responsible for monitoring and reviewing Pantheon’s sustainability integration approach for PIN. She also ensures that the Board is kept informed of material sustainability and climate risks that may impact PIN’s portfolio.

Our

approach

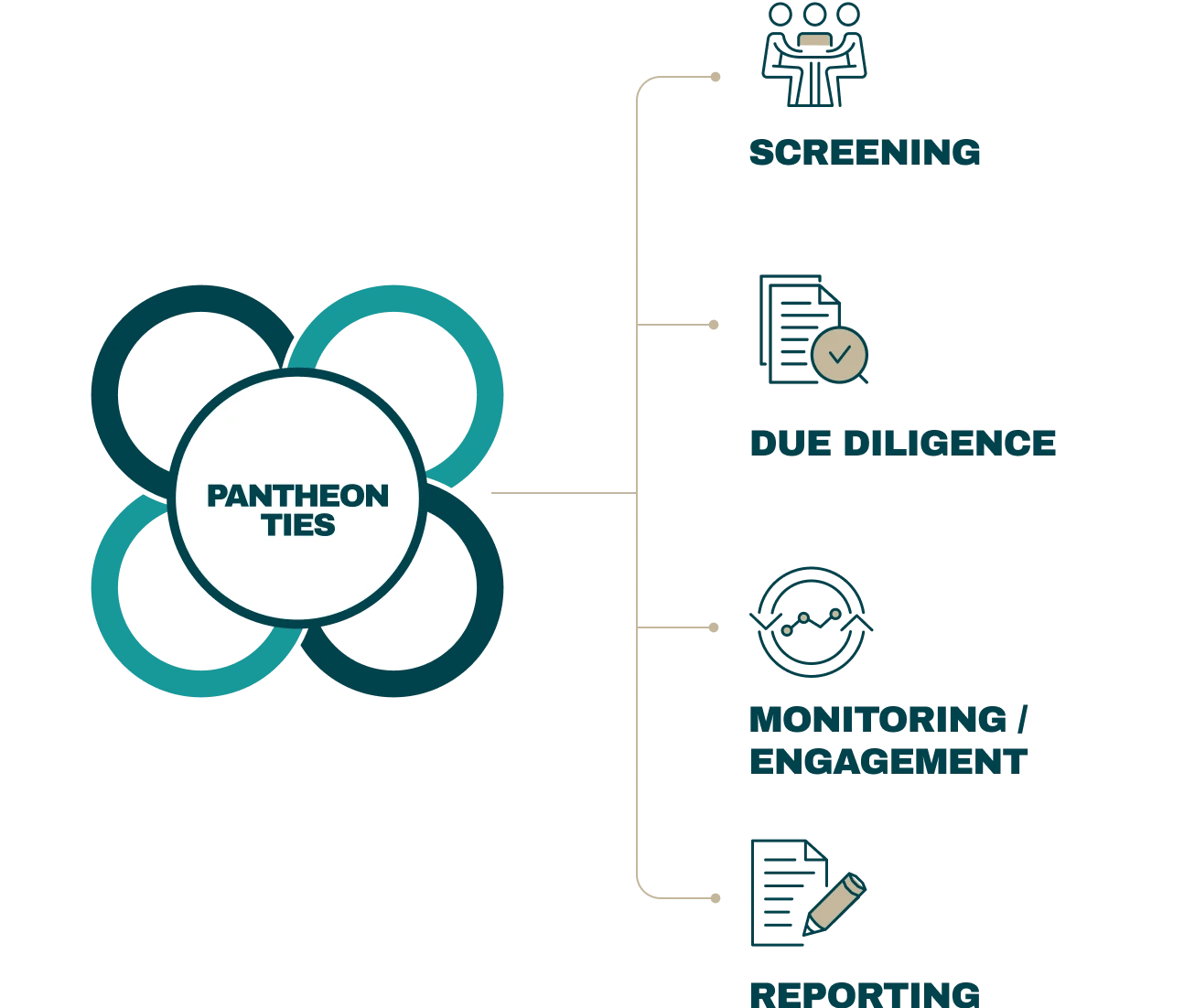

Pantheon’s approach to sustainability integration is rooted in the belief that companies focusing on material sustainability considerations can build business resilience, strengthen positioning, enhance investor confidence and reduce regulatory uncertainty. In 2023, it crystallised a sustainability ethos and approach into an enhanced sustainability framework, “TIES”. This sustainability framework provides clarity on the purpose and central tenets of the sustainability approach at Pantheon. Each element of Pantheon TIES informs and cuts across all sustainability activities.

Transparency

Transparency

Seeking to enhance transparency through improved practices, tools, and resources. Transparency leads to improved decision-making, monitoring, engagement and reporting.

Engagement

Engagement

Collaborating with clients, managers and peers to develop and share best practices on assessing sustainability factors.

Integration

Integration

Aiming to integrate consideration of material sustainability factors in each stage of the investment process.

Solutions

Solutions

Endeavouring to explore the range of investment opportunities and develop innovative investment solutions to meet clients’ requirements.

Guided by the TIES monitoring and engagement framework, sustainability considerations are systemically integrated across the investment lifecycle, including screening, due diligence, monitoring/engagement and reporting. Doing so enables the team to consistently and efficiently identify and manage sustainability-related risks and opportunities to drive value for clients.

Read PIN’s latest Sustainability Report to find out more about how sustainability factors are integrated throughout the investment, monitoring and reporting processes.

Embedding material sustainability considerations throughout Pantheon's investment process supports our wider objective to manage risks and create value for our clients, such as PIN.

Eimear Palmer Partner, Global Head of Sustainability and Chair of the Pantheon Sustainability Committee

Our sustainability partnerships

Pantheon partners with leading industry organisations championing global standards and best practices in reporting and monitoring of sustainability issues more broadly, and climate risks and opportunities in particular.

PRI

The UN Principles for Responsible Investment (PRI) is the world’s leading proponent of responsible investment. Its purpose is to understand the investment implications of sustainability factors and to support its investor signatories in incorporating these factors into their investment and ownership decisions. Pantheon signed the PRI in 2007.

iCI

Pantheon is a member of iCI (Initiative Climat International), a collective commitment to unnderstand and reduce carbon emissions of private equity-backed companies that is backed by the PRI.

BVCA

Pantheon is a long-standing member of the BVCA, the UK private equity industry association, and is proud to be represented on its Sustainability Committee.

Invest Europe

Pantheon is a member and supporter of Invest Europe, the European private equity trade association, and supports its efforts to promote best practice in sustainability through representation on its ESG Committee.

TCFD

Pantheon is a supporter of the Task Force on Climate-related Financial Disclosures (TCFD) and contributed to a guide, produced by the BVCA and iCI, on how to implement TCFD recommendations in private equity.

GPCA

Pantheon is represented on the board at GPCA (Global Private Capital Association) and chairs its Asia Council. The GPCA promotes sectors, strategies and deals that will drive investment returns and meet societal needs.

Case studies

Discover some of the private companies PIN has backed with sustainability at the core of the business.

Current

Taking "Action" for sustainabilityAction has set itself ambitious and measurable sustainability targets to meet the expectations of its cost- and eco-concious customers.

Current

Ambienta IVAmbienta is a European private equity manager that believes sustainability drives value.

Downloads

| PIN Sustainability Report 2024 | pdf (12.3 MB) | |

| PIN Annual Report and Accounts 2024 | pdf (9.5 MB) |

Investing in PIN is simple – here’s how

Shares in PIN are traded on the London Stock Exchange. An investment in PIN can be made through a broker, financial intermediary or through a variety of online platforms.